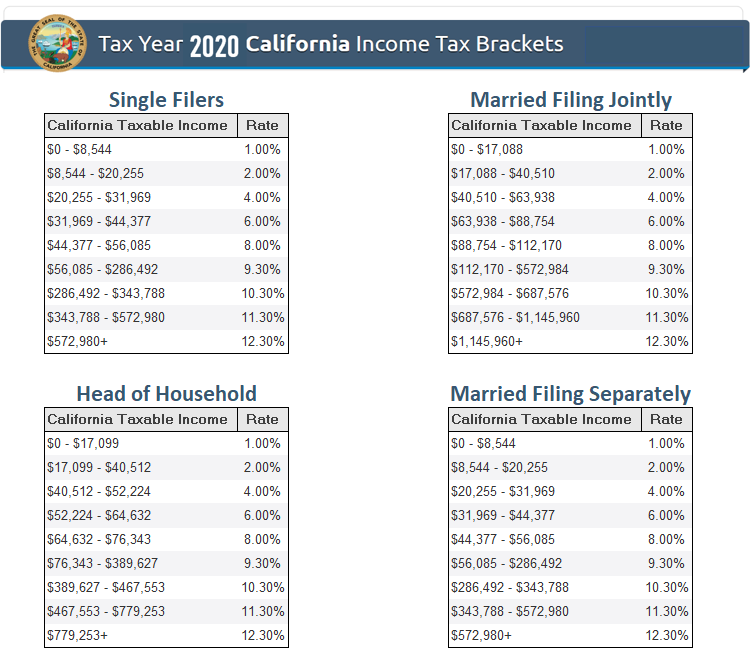

The standard deduction in California is $4,803 for single filers and $9,606 for joint filers. That is income after all applicable deductions and exemptions have been subtracted. It’s important to note that those rates do not apply to actual income, but adjusted gross income. The table below further demonstrates tax rates for Californians. That’s the highest rate in the U.S., but it only applies to income earners with over $1 million in taxable income. It functions like a normal income tax and means that the top marginal rate in California is, effectively, 13.3%. As part of the Mental Health Services Act, this tax provides funding for mental health programs in the state. Technically, tax brackets end at 12.3% and there is a 1% tax on personal income over $1 million. In all, there are 9 official income tax brackets in California, with rates ranging from as low as 1% up to 12.3%. This is similar to the federal income tax system. California Income TaxesĬalifornia has a progressive income tax, which means rates are lower for lower earners and higher for higher earners. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

Ca tax brackets 2019 single free#

SmartAsset’s free tool matches you with up to three vetted financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. For example, if you earn less than $66,295 per year, your marginal rate in California will be no higher than 8%.Ī financial advisor can help you understand how taxes fit into your overall financial goals.

Of course, income tax rates will vary depending on each taxpayer’s individual finances. The average homeowner pays just 0.71% of their actual home value in real estate taxes each year. The Golden State fares slightly better where real estate is concerned, though. Its base sales tax rate of 7.25% is higher than that of any other state, and its top marginal income tax rate of 12.3% is the highest state income tax rate in the country. Gas tax: 53.90 cents per gallon of regular gasoline, 41.00 cents per gallon of dieselĬalifornia has among the highest taxes in the nation.Property tax: 0.71% average effective rate.

0 kommentar(er)

0 kommentar(er)